The game is rigged - in your favor

Exploring the incredible advantages of being an individual investor

To begin with, I would like to thank all of you for being subscribed. I’ve recently translated all posts to English and changed the name to Asymmetric Investments - to reflect my investment approach and the type of opportunities I’m mostly looking at.

Now, let’s get to today’s article:

It may sound counterintuitive - how could a retail investor have any advantage over all the sophisticated institutions and hedge funds that employ some of the smartest people out there? Against guys that can easily afford to spend $30k per year on a bloomberg terminal?

First of all, investing became incredibly democratized in recent years. The comissions have dropped so much that I can now buy shares of Apple, or even some obscure micro-cap companies and pay just 2€ in fees. In addition, there are plenty of amazing tools like screeners and trackers of financials, insider purchases or even app store rankings - many of which are completely free.

And yet - most new investors do lose money. One reason is that they often chase the current “hot thing” - doesn’t matter whether it is Tesla, Dogecoin, SPACs, a bankrupt car rental company, GameStop or some AI stock trading at 100x earnings. The appeal of getting rich quick is just too strong.

However, there are investment approaches and sectors of the market where the situation is flipped and where the odds are in favor of the individual investor. Let’s explore them.

Small Cap Stocks

When you are an individual investor, nothing prevents you from buying shares in the smallest publlicly traded companies out there (<$100m). In this sector, you won’t find many institutional buyers or investment funds competing with you (especially outside of the US market). Why? Imagine you are a portfolio manager in charge of a 5B fund. If you were to buy a 10% stake in a 50m company - it would represent just a 0.1% of your portfolio - hardly enough to make any impact. In addition, institutions are often simply not allowed to buy anything with a market cap smaller than X dollars.

Therefore, small cap stocks can have more reasonable valuations and you can find mispricings and interesting opportunities more often. Let’s look at some current examples from the canadian market (just my opinion):

AEP.V is a growing and profitable company with a market capitalization of ~$50m. They recently announced an acquisition that almost doubles their earnings power and gave a hint that more acquisitions could be coming. Yet since that day the share price has risen by a mere 4.5%.

AirIQ - a tiny business with recurring revenues and a long history of profitability and double-digit growth. Balance sheet is debt-free with a sizeable pile of cash. Their growth has accelerated in recent quarters, yet the stock keeps trading at a single-digit P/E.

And if I didn’t convince you yet, feel free to listen to Mr. Munger propose this idea himself (3:16):

In addition, it is easier for these businesses to expand, as they are starting from a smaller base. It only takes one succesfull new product or a few acquisitions to double your sales from 50m to 100m. But as you get bigger, it gets much, much harder. Imagine a large company like Coca-Cola, with revenues of 44 billion. Even if they do everything right, introduce new products and do smart acquisitions, there is no way they could double their sales in the next few years. They are simply too big.

And if you are looking for stocks that could 3x, 5x or even 10x in value, high growth in sales and profits is definitely one of the key prerequisites.

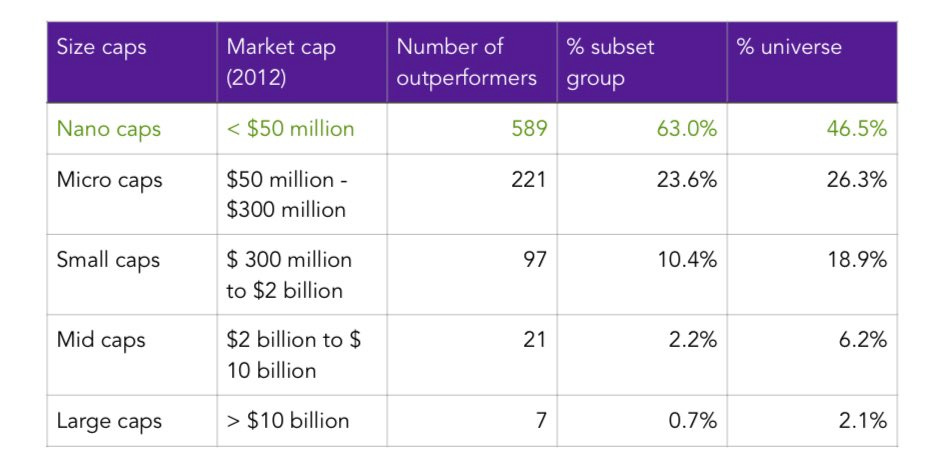

There are even studies showing that majority of the best performing stocks begin as small/micro/nano caps. For example this one looked at all the companies that did at least 10x between 2012 and 2022. They found that 97% (!) of them started out with a market cap below $2 billion. On the other hand, large caps (>10B) represented only 0.7%.

Another point is that in small companies, you often find the founder and management still holding large portion of the shares. This should, in most cases, lead to incentive alingment with the shareholders and discourage management from taking on excessive leverage or from diluting the shares.

I’m not saying that investing in small/micro caps is the best aprroach nor that it’s easy. Far from that. But if you are looking to maximize your returns and are willing to do the reaserch, this might be the place to look into.

The Discovery Process

There is another fascinating thing about being an individual investor. You can participate in the so called “discovery process” that is taking place in the small cap space.

To summarize it, you are looking for small, growing companies that are completely unknown to the investment public, get no analyst coverage and have little to no institutional ownership.

You try to buy them when an inflection point comes and their revenue growth accelerates (by introducing a new product, for example). You can actually be one of the first people to notice this positive development - and that allows you to buy shares cheaply.

Then, you wait. As the company continues to grow, the investment world starts to take notice. Articles are being written, analysts start to cover the company and if it’s large enough, institutions can finally buy. This increases the demand for the shares, but there is often nobody selling them - insiders hold a large portion and have no reason to sell. This dynamic alone can lead to a huge increase in the share price - change in the market valuation from a P/E 10 to 15 already gives you a 50% return. Add to that the actual growth in earnings and you have a recipe for success.

There is of course more to this approach, initialy brought to me by Paul Andreola, who successfuly applies it in the Canadian market and even publicly shares the key parts of the process. I definitely recommend this presentation to learn more (the paragraph above is mostly just summary of this video):

Long-term Focus

When you work for a large institution and your job involves making investment decisions, maximizing long-term results is probably not your primary focus. Even if you have an amazing strategy that will 10x the portfolio in 10 years, there is no point in it if you get fired after 2 years of underperformance (or if your investors withdraw all their money).

This leads many portfolio managers to having broadly diversified portfolios consisting of well-known stocks. Even if they discover a promising new business with huge prospects, they won’t probably risk embarassing themselves if the thesis doesn’t work out. Thanks to this, their performace won’t lag the market too much. But it won’t beat it by much either.

As an individual investor, you don’t have to worry about any of that.

Do you really like a particular company? Nobody prevents you from making it 50% of your portfolio.

Do your holdings move 10% up and down each day? So what.

Is your portfolio full of weird, unknown or boring companies, that nevertheless make money and have very good future prospects? There are no investors or superiors that woud question you.

Do you own a stock that will probably do nothing for the next 2 years but then could multiply in value many times? Cool, no one is rushing you.

Did the market crash and your portfolio is down 30% ? That could even be a good thing. If the companies themselves are doing well, you can just buy more and try not to look at the red numbers too much. In 10 years you will probably thank yourself.

There are no rules

You can freely choose the investment approach that suits you the best. You don’t want to spend any time with it? You can buy a S&P500 ETF, do nothing and still outperform most hedge funds and active managers out there.

Do you like discovering and analyzing new companies? Great, you can build a whole portfolio to your own liking.

Do you want to put all your money into a company that acquires and operates strip clubs? Yeah, nobody will stop you.

There are no rules. There is no “right” way to do this. Just pick an approach you like, stay curious and never stop learning. It will pay off.

The ideas shared in this article aren’t new. Many investors have written about them before - Peter Lynch or Chris Mayer, for example. Yet I still feel like most individual investors aren’t really aware of the advantages they could utilize. And if you want to help me spread this message, feel free to share this article with others:

Thanks for reading!