Atlas Engineered Products - Industry Roll-up in the Making

Analysis of a Canadian micro-cap stock with a huge expansion potential.

“Never invest in any idea you can’t illustrate with a crayon“ – Peter Lynch

There is beauty in simplicity - and this is especially true in investing. If we plan to hold a stock for the next several years, we need to have at least a rough idea of how will the business look at that time and whether it will exist at all.

Given the current rapid development of (not only) artificial intelligence, I'm starting to find that predicting developments in some technology stocks is very difficult. Take Snapchat, for example. How likely is it that they will still be around in 10 years? It's really hard to say, right?

That's why I've started to focus on companies that are simple to understand, predictable and at a low risk of technological obsolescence. With these thoughts, I came across Atlas Engineered Products (AEP.V), a Canadian micro-cap company that makes wood trusses and prefabricated walls for residential and commercial construction. It has a simple business model and a strong market position that allows it to profit from the real estate shortage in Canada. All of this makes it an interesting candidate for a long-term investment.

Quick Overview:

Small, profitable company with huge potential for future expansion and M&A

Experienced management with a history of good capital allocation

Consolidation of a highly fragmented industry

Many retiring owners → cheap acquisiton opportunities (avg 4x EBITDA)

Canadian housing shortage + population growth should ensure high demand in future years

Revenue growth >30% annually

Cheap valuation: P/E = 6, EV/EBITDA = 4,2, P/B = 2

High insider ownership, founder-led

Business Model

Atlas currently designs and manufactures mostly wooden roof trusses. Its services are beneficial to real estate developers for several reasons:

The roof truss is manufactured off-site, which makes construction faster and cheaper

There is a severe shortage of construction workers in Canada - thus, prefabricated parts represent a great alternative

Atlas has an in-house team of engineers who can handle the entire design and engineering of the product before it goes into production. In addition, they help with acquiring building permits

Wood products are sustainable and their manufacturing produces fewer emissions than alternatives

Atlas is gradually adapting to the market demand and is now starting to offer also floor trusses and prefabricated panels for wall construction. Here lies a great potential for organic growth. If someone orders walls and floors in addition to roof trusses for their building, the order will bring a multiple of sales with minimal additional effort.

Since its IPO in 2017, the company has been able to quickly grow from one to its current 7 locations, spread out near Canada's largest population centers:

Industry roll-up in the making?

The main pillar of this investment thesis is a bet on a successful "roll-up" of the sector. The founder and CEO of the company is well aware of this opportunity and has listed the company on the stock exchange precisely to raise capital for expansion. What led him to this idea?

The market is highly fragmented, most companies have only one location and are not very well managed

Lack of succession in many companies allows for cheap acquisitions (average 4x EBITDA)

Smaller players do not have the resources to invest in production automation

According to estimates, Atlas is the second largest company in the market, yet has only 2% market share so far. The room for further growth is therefore huge.

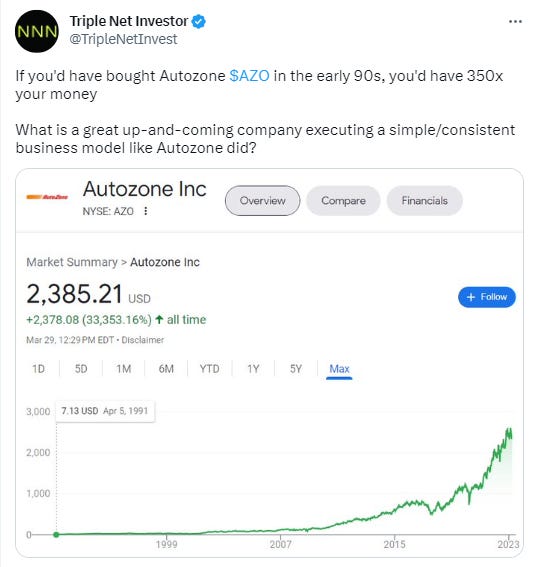

Performing a successful roll-up is certainly not easy, but it can yield incredible results. Great example is Autozone, from which Atlas' management takes inspiration. It is also a very simple business (selling spare car parts), but despite this, $AZO shares have risen more than 300-fold since the 1990s and the company currently has over 7,000 branches.

However, acquisitions only create value if the acquired companies can be improved and made more efficient. In the case of Atlas, this is working very well. Newly acquired companies benefit from the introduction of automation in production, access to more orders and, last but not least, there are economies of scale (individual branches can collaborate on orders and share resources, distribution is also streamlined).

Examples of successful acquisitions can be found in the investor presentation:

In this particular case, sales more than tripled, coupled with a significant increase in EBITDA margin. If future acquisitions are similarly successful, shareholders could be handsomely rewarded.

Below we can see the complete list of past acquisitions:

The advantage of this business is that prefabricated wooden products are quite bulky and it is not worth it to transport them over long distances. For this reason, there is no need to fear competition from overseas and some branches have essentially a local monopoly. This is the same dynamic as with the gravel pits and quarries that Peter Lynch admires:

“What makes a rock pit valuable is that nobody else can compete with it. The nearest rival owner from two towns over isn’t going to haul his rocks into your territory because the trucking bills would eat up all his profit. No matter how good the rocks are in Chicago, no Chicago rock-pit owner can ever invade your territory in Brooklyn or Detroit. Due to the weight of rocks, aggregates are an exclusive franchise. You don’t have to pay a dozen lawyers to protect it.”

Peter Lynch, One Up On Wall Street

Financials

The company's financials look very good, but it should be noted that this sector of the economy is very cyclical and currently might be at its peak:

ROA 19%

ROCE 30%

Net margin 15%

Revenue growth 47% per annum (5Y CAGR)

Since 2018 Atlas focused mostly on integration of the new acquisitions. However, the CEO Hadi Abassi has recently stated that he had resumed his search for new targets. Balance sheet of the company also suggests this possibility, as there is more than 13m of cash ready for deployment.

Canadian Housing Shortage

A mismatch between supply and demand in the real estate market should ensure stable demand for Atlas' products in the future. Canada's population grew by over a million people for the first time ever last year. Coupled with a lack of new construction, this has resulted in severe shortages and sharp price increases. And unless production increases, the situation is projected to get even worse. It is perhaps best illustrated by this CMHC analysis:

It projects that at the current rate, 2.3 million new units will be built by 2030. But to make housing affordable again for all Canadians, as many as 5.8 million new units will be needed. This imbalance is already being addressed by the Government of Canada, which has set aside $4 billion to support municipalities in housing construction. And of course, Atlas will benefit significantly from all these repairs and new construction.

Valuation

The valuation looks very favourable at first glance - hovewer, we must take into account the possible slowdown in construction due to rising interest rates (and more expensive mortgages):

P/E = 6

EV/EBITDA = 4,2

P/B = 2

FCF yield = 13 %

In my opinion, the current valuation is still very compelling and the drop in profitability in the coming months will not be severe. Why?

The CEO mentioned in an interview that he has an idea of the revenue development for about six months ahead and he doesn't see any significant slowdown yet

Deloitte Canada estimates that the central bank will no longer raise rates and could even cut them at the end of the year. It also expects the bottom in the housing market to be reached this fall (however, such estimates should be taken with a grain of salt)

Moreover, if a significant downturn in the real estate market indeed occurs and construction comes to a halt, Atlas will have plenty of great opportunities for cheap acquisitions. As a publicly listed company, it will also have much better access to financing than smaller competitors. And when the market picks up again (which is very likely, given the structural real estate shortage), its market position would become even stronger.

Another interesting thing to note is that management has been buying back shares at prices around 0.9 CAD in recent weeks.

The Conclusion

Atlas Engineered Products is a well-run company with experienced management that has proven it can allocate capital wisely. The history of succesfull acquisitions, high insider ownership, and structural tailwinds suggest that in the long term, there is a high probability that Atlas will perform very well.

While thinking about new investments, I like to take inspiration from the strategies of Peter Lynch and Chris Mayer. They both look for small, quality companies that have the potential to multiply their value several times over. And while writing this article, it occurred to me that Atlas meets a number of their criteria:

The company is small and profitable, yet not widely followed and trades at a low valuation

It is a simple and easy to understand business

Insiders, along with the founder, own a large share of the company

Significant revenue and earnings growth

High return on capital employed (ROCE, ROIC)

The company does not pay dividends, it reinvests everything in further development

Given these characteristics, I decided to invest in Atlas. I have opened a position at 1.03 CAD and plan to add to it in case of price declines.

If you liked this analysis, I would greatly appreciate a share or a follow here on Substack. In the future I plan to write more about my investment approach, about the composition of my personal portfolio and, of course, about interesting companies with high future potential. Also, you can comment your ideas about what stock I could look at next!

Warning: This article is intended solely to educational purposes and reflects only my personal opinions. It should never be taken as an investment recommendation.

More useful resources about AEP:

Super analýza, také již delší dobu sleduji a vlastním. Další typ by mohla bát Atkore - ATKR, co vy na to ?